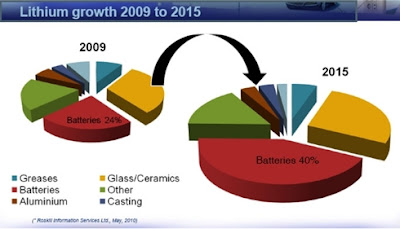

Recently, the demand

and the price for lithium are increasing. The uses in lithium expend in

vehicles, ceramics, electronics and lubricants. By the exploding popularity of

iPads and the increasing sales of hybrid vehicles, they are few investors

planning to invest in producers of lithium for batteries. Lithium’s use in

technology has been increasing about 20% a year since 2000. There is high

demand in lithium for the making of many electronics and car batteries. The

market for tablet computers and hybrid electric vehicles is growing faster than

expected. Apple’s iPad is widening and its lead as consumers’ top choice.

Without lithium, the whole mobile technology or hybrid car technology would not

have been possible.

(Diagram 1)

Aside from Talison

Lithium Ltd (TLH), the trio of Rockwood Holdings (ROC), Sociedad Quimica y

Minera de Chile (SQM) and FMC Corp. (FMC) control most of the world’s

production in lithium. Besides, Rio Tinto Group (RIO), the third biggest mining

company may enter the lithium business by opening a new mine in Serbia. Once

the facility begins production, it says it will be capable to produce about 20%

of the world’s output of the metal. However, Sociedad Quimica y Minera (SQM) is

the only member of the oligopoly whose stock has been in the red for 2012.

An

oligopoly is a market when only a small number of large sellers competing with each

other and sell a product or service. There are homogeneous or differentiated

products. Products such as lithium can be homogeneous, a pure oligopoly. Prices

in an oligopoly tend to remain stable because if one company increases the

price too much, the others seem to do the same. The lithium producers have

publicly stated that the pricing over the past two years have increased. In

2011, FMC Lithium announced three times that they would increase pricing in

their lithium products. Additionally, FMC just announced the price will

increase on 18th of June, 2012. (Diagram 2) Furthermore, Talison

Lithium, the only pure-play lithium producer, announced in December of 2011

that it will increase the prices by 15% and expects to increase the prices

again. A price increase has been agreed with the customers. Moreover, in

oligopoly, it’s not easy for potential rivals to enter the industry. There are

high entry barriers or natural entry barriers. Barriers to entry exist such as

copyrights, patents, advertisements and also economics of scale (EOS).

(Diagram 2)

Last year, Argentina is promoting the idea of an

OPEC-like cartel for lithium. Argentina, Bolivia and Chile, which total control

85% of world’s reserves of lithium, a key component in electric car batteries.

In the near future and with the high level of production, Argentina, Bolivia

and Chile may control the lithium market. A ton of lithium worth $2,500 in 2004 and now sells for around $6,000.

In

conclusion, lithium is going to be very important to the future world of hybrid

electric vehicles because lithium’s use in batteries for electric vehicles.

Other than hybrid electric vehicles, lithium is also used for many electronics such

as smartphones, tablets and laptops. No doubt, the demand and the price for

lithium will be continuing increasing in the future.

(Diagram 3)